Personal finance management apps are a great budgeting tool for individuals to track and manage their finances effectively. These apps offer a customizable budget feature that helps users get a clear financial picture. Additionally, they provide access to various financial products to further enhance financial management. These budgeting tools provide an overview of one’s money management by allowing users to monitor income, expenses, and savings in one place. With these apps, users can easily track their account balances and create a customizable budget. With many budgeting apps available, beginners can gain control over their finances and work towards their financial goals using mobile apps. These apps help users manage their money and track their bank account.

By utilizing these apps, users can easily note their spending habits and allocate funds into different “envelopes” for specific savings goals. These apps also help users create budgets to manage their variable expenses and track their money in their bank account. This basic plan helps beginners develop a clearer view of their financial health and make informed decisions about saving and spending with the help of personal finance apps. It is important to find the right budgeting app, and luckily there are many free budgeting apps available that can assist in managing your finances effectively. Whether it’s tracking expenses, setting up automatic savings plans, or managing financial products, personal finance management apps provide the necessary tools for individuals to take charge of their money. These apps help individuals stay within their budget, keep track of cash flow, and manage their accounts effectively.

Decoding Budgeting Apps

What Is a Budgeting App?

A personal finance app is a digital tool that helps users create and manage budgets, track their accounts, and monitor their spending. These financial products are designed to provide users with an easy and convenient way to stay on top of their finances. It provides an easy and convenient way to track income, expenses, and set spending limits for different categories using the right budgeting app. With this free budgeting app, you can stay on top of your personal finances and manage your money effectively. These apps, such as Quicken Deluxe, often present financial data in visual representations, making it easier for beginners to understand their budget and account. They can help users manage their money efficiently.

How To Budget Using Apps

Budgeting apps offer step-by-step guidance on setting up budgets for financial products based on individual goals. These apps, such as Quicken, help users track and manage their accounts and money effectively. Users can input their income sources and allocate funds to various expense categories within the personal finance app. This helps them manage their budget and keep track of their account and money. By using budget tracking apps like Quicken, users can easily monitor their spending patterns and identify areas where they can cut back and save more money. This can have a positive impact on their credit score and financial ratings. Personal finance apps provide real-time insights into financial habits, empowering individuals to make responsible financial decisions. Whether you’re looking for the right budgeting app or a free budgeting app, these apps can help you track your expenses and improve your credit score.

Do Budgeting Apps Really Work?

Studies have shown that using budgeting apps like Quicken can be a quick and effective way to improve your financial habits and manage your money. These apps can help you track your expenses, create a budget, and stay on top of your credit score month after month. People who use budget apps like Quicken tend to save more money compared to those who don’t utilize them. These apps can also help improve your credit score, which is important for your financial well-being. Additionally, using a budget app from a reputable company can provide you with the tools and guidance you need to stay on track with your finances. By allowing users to track their spending and manage their money, budgeting apps like Quicken create awareness around personal finance and encourage responsible behavior. These apps can also help users improve their credit score by providing insights and tools to manage their finances effectively. Additionally, using a budgeting app from a reputable company can provide peace of mind knowing that your financial information is secure.

The ability of these budget apps to track spending is particularly beneficial for beginners who may not have a clear understanding of where their money goes each month. This is especially helpful for individuals looking to improve their credit score. With the help of budgeting apps, users can easily visualize their expenses and see which categories are eating up a significant portion of their income. This can be especially helpful for managing money and improving one’s credit score.

Moreover, many budgeting apps offer additional features such as bill reminders, goal-setting tools, investment tracking capabilities, and even credit monitoring. This free budgeting app offers users a comprehensive overview of their finances, including credit, all in one place. It helps users stay organized and achieve their long-term financial goals.

For example, let’s say you want to save up for a vacation but struggle with overspending on dining out. Personal finance apps can help with budgeting and credit management. A personal finance app can help you set a specific monthly limit for dining out expenses and send notifications when you’re approaching or exceeding that credit limit. This simple budgeting app feature can act as a gentle reminder to curb your spending and allocate more funds towards your savings goal. It is a great addition to any personal finance app, helping you stay on track with your credit and financial goals.

Top Features in Personal Finance Apps

Expense Categorization

Budgeting apps make it a breeze to categorize expenses into various groups like groceries, utilities, entertainment, and credit. This categorization is essential for users of a budgeting app or personal finance app as it helps them gain a clear understanding of where their credit is going. By using a budgeting app or personal finance app, individuals can have their expenses neatly organized, allowing them to make informed decisions about future spending and manage their credit effectively. Some personal finance management apps even go the extra mile by offering automated categorization based on transaction data, making it easier to manage your budget and track your credit. This means that the budget app itself will analyze and assign categories to credit expenses, saving users time and effort.

Account Linking

One of the standout features of personal finance management apps is the ability to link bank accounts or credit cards for automatic transaction syncing. This feature eliminates the tedious task of manually entering every single credit transaction into the app. By linking their accounts to our personal finance app, users can enjoy accurate tracking of their income, expenses, and credit without having to lift a finger. This convenient budgeting app feature allows individuals to view all their credit and financial information in one place without the hassle of logging into multiple accounts.

Security Measures

Security is paramount. Personal finance management apps prioritize user security by implementing robust encryption protocols, ensuring the safety of credit and personal information. These credit apps often employ bank-level security measures to safeguard sensitive financial data from unauthorized access or breaches. To provide an extra layer of protection for your credit, many apps offer features like two-factor authentication and biometric login options such as fingerprint or facial recognition technology.

Best Budgeting Apps for Beginners in 2024

YNAB (You Need A Budget)

YNAB is a popular budgeting app that offers a range of features to help beginners manage their personal finances effectively, including credit. One of the standout benefits of using YNAB, a budgeting app, is its ability to facilitate collaboration between individuals or couples who want to manage their shared finances efficiently and track their credit. With this app, partners can easily collaborate on budgets, expenses, savings goals, and credit, ensuring that both parties are on the same page. YNAB also allows couples to track joint accounts as well as individual spending within the app, providing a comprehensive overview of their credit and financial situation.

However, it’s important to note that some budgeting apps may lack robust collaboration features like YNAB does, which can be crucial for managing credit effectively. This can make it challenging for couples who want to effectively manage their finances together with the help of a budgeting app and keep track of their credit. Compatibility issues across different devices or operating systems can hinder seamless synchronization between partners’ accounts when using a budgeting app, causing inconvenience and potential discrepancies in credit and financial data. Privacy concerns may also arise when both partners have access to each other’s credit and financial data within the app, which might be uncomfortable for some credit users.

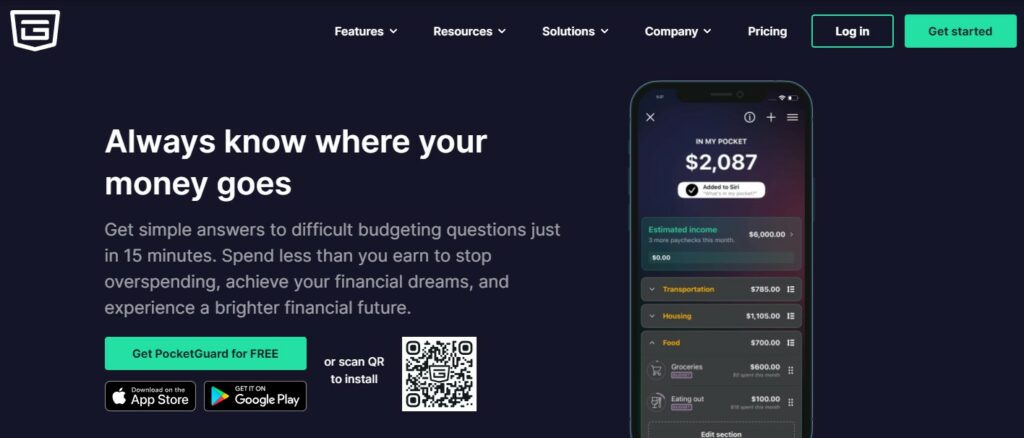

PocketGuard

PocketGuard is another budgeting app that caters specifically to beginners by offering a user-friendly interface and intuitive design. With PocketGuard, you can easily track and manage your credit, all through its intuitive design and user-friendly interface. It stands out among other credit apps with its unique features such as bill reminders, goal tracking, and investment integration. These features help users stay organized and motivated in achieving their financial goals, including managing their credit. PocketGuard offers customizable spending limits and alerts for users to manage their credit. With this feature, users can set boundaries and receive notifications when they approach or exceed their credit budgets.

While PocketGuard has many advantages for beginners in personal finance management, it also has its limitations when it comes to credit. For example, some users may find certain credit features lacking compared to more advanced budgeting apps on the market. There may be limited options for credit customization based on specific credit needs or credit preferences. However, considering its user-friendly interface and helpful features, PocketGuard remains a solid choice for beginners who want to take control of their credit and finances.

Specialized Budgeting Apps for Various Needs

Best App for Financial Goals

Having clear financial goals is crucial. And if you’re someone who wants to track and achieve those credit goals effectively, there are specialized budgeting apps available that can help you stay on top of your credit game.

One such app that stands out in assisting with financial goals and managing credit is [App Name]. This app allows users to set specific financial targets, whether it’s saving for a down payment on a house, paying off student loans, or improving their credit. With its user-friendly interface and customizable budgeting tools, [App Name] helps individuals create realistic budgets while providing insights into their spending habits. This can be especially useful for those looking to improve their credit.

The app also offers features like spending limits, which notify users when they are approaching their set limits in various expense categories. This way, you can stay accountable and make informed decisions about your spending.

Best App for Couples

Managing finances as a couple can be challenging at times. However, with the right budgeting app designed specifically for couples, you can streamline your financial management process and ensure transparency between partners.

[App Name] is an excellent choice for couples looking to manage their finances together. It allows users to create shared budgets, where both partners can contribute their income and expenses. This collaborative approach helps couples stay organized and aligned with their financial goals.

[App Name] provides real-time updates on shared expenses and tracks individual contributions towards joint savings accounts or debt repayments. The app also offers secure communication channels within the platform, enabling seamless coordination between partners regarding financial matters.

Best App for Passive Saving and Investing

If you’re interested in passive saving and investing but find it challenging to get started or stay consistent with your efforts, there’s an app that caters specifically to this need.

[App Name] is an innovative budgeting tool that simplifies the process of saving and investing by automating it. With this app, you can set up recurring transfers from your checking account to a designated savings or investment account. This way, you can effortlessly save and invest without having to think about it actively.

The app also offers features like round-up options, where it rounds up your everyday transactions to the nearest dollar and automatically saves or invests the spare change. This small but consistent approach helps you accumulate savings over time.

Furthermore, [App Name] provides personalized investment recommendations based on your financial goals and risk tolerance.

Evaluating the Cost of Finance Management Apps

Free Version Duration

Many personal finance management apps offer a free version for users to get started. The duration of the free version varies from app to app, with some offering it indefinitely and others limiting it to a trial period.

During this free period, users can explore the features and functionalities of the app without any cost. This allows beginners to test out different apps and find one that suits their needs before committing to a paid version.

However, it’s important to note that while the free versions may provide basic budgeting tools and expense tracking features, they often come with limitations compared to their paid counterparts. For example, certain advanced features such as investment tracking or customized reports may only be available in the paid versions.

Upgrading to Paid Versions

Once users have familiarized themselves with a personal finance management app and want access to more advanced features, they can consider upgrading to a paid version. The cost of these paid versions varies depending on factors such as the complexity of features offered, additional benefits provided, and whether it is a one-time purchase or subscription-based model.

Paid versions typically unlock premium features that enhance financial planning capabilities. These can include options like investment portfolio tracking, bill payment reminders, goal setting tools, and detailed expense categorization. By upgrading to a paid version, beginners can gain deeper insights into their financial picture and optimize their money management strategies.

While there is an associated cost with upgrading to a paid version, it’s essential for beginners in personal finance management to weigh the potential benefits against their specific needs and budget constraints. Some individuals may find that the additional features provided by the paid versions are worth the investment if they align with their financial goals.

It’s also worth considering whether the increased functionality justifies the ongoing cost if opting for a subscription-based model. Beginners should evaluate how frequently they will use these advanced features and determine whether they are willing to pay for them on a recurring basis.

Choosing the Right App for You

Who It’s For

Personal finance management apps are designed to help individuals, especially beginners, take control of their finances. These apps cater to people who want to track their expenses, create budgets, save money, and gain a better understanding of their financial habits. Whether you’re a college student trying to manage your limited funds or a young professional looking to build good financial habits, these apps can be incredibly useful.

Methodology for Picking the App

There are a few factors to consider. First and foremost is ease of use. Look for an app with an intuitive interface that doesn’t require a steep learning curve. After all, the purpose of these apps is to simplify your financial life, not make it more complicated.

Another important aspect is compatibility. Check whether the app is available on both iOS and Android platforms so that you can access it regardless of your device preference. Consider whether the app syncs across multiple devices so that you can seamlessly manage your finances from your phone, tablet, or computer.

Security should also be a top priority when choosing a finance management app. Ensure that the app uses encryption technology and has robust security measures in place to protect your sensitive information. Look for apps that have positive reviews regarding their security features and data protection policies.

Customization options are another essential factor to consider. Different individuals have different financial goals and preferences. A good personal finance app should allow you to customize categories, set spending limits, and tailor notifications according to your needs.

Lastly, take into account any additional features offered by the app. Some apps provide educational resources or tips on saving money and investing wisely. Others may offer bill payment reminders or even allow you to link your bank accounts for automatic expense tracking.

By considering these factors – ease of use, compatibility, security, customization options, and additional features – you can narrow down your choices and find the personal finance management app that best suits your needs. Remember to read reviews, compare features, and perhaps even try out a few different apps before settling on one.

The Importance of User Reviews and Ratings

User reviews and ratings play a crucial role. Let’s delve into why they are so important.

Number of Ratings

The number of ratings a finance app has received can provide valuable insights into its popularity and reliability. A higher number of ratings generally indicates that more users have tried the app and shared their experiences. This can be an indication of the app’s credibility and usefulness. It’s like getting recommendations from a large group of people who have already tested the waters.

Analyzing User Feedback

User feedback is like gold. By reading through reviews, you can gain valuable information about the app’s features, ease of use, customer support, and overall user experience. Pay attention to both positive and negative reviews as they offer different perspectives.

Positive reviews often highlight the strengths of an app, such as its intuitive interface or helpful budgeting tools. These insights can help you identify the key features that make an app stand out from others in the market.

On the other hand, negative reviews shed light on potential issues or limitations with the app. They may mention bugs, glitches, or difficulties in syncing accounts. While every app may have some negative feedback, pay attention to recurring themes or major concerns raised by multiple users. This will give you a better understanding of any potential drawbacks before committing to using a particular app.

Consumer ratings also provide an at-a-glance overview of how users rate an app overall. Look for apps with higher average ratings as they are more likely to deliver a positive user experience.

It’s worth mentioning that while user feedback is important, it should not be your sole determining factor when choosing a personal finance management app. Consider your own unique needs and preferences as well.

Ensuring Your Data Security with Finance Apps

Availability Across Devices

Having access to your financial data anytime and anywhere is crucial. Personal finance management apps cater to this need by offering availability across devices. Whether you’re using a smartphone, tablet, or computer, these apps ensure that you can access your financial information conveniently.

With the availability of finance apps on multiple platforms such as iOS, Android, and web-based interfaces, users have the flexibility to manage their finances on the go. This means you can check your account balances, track expenses, set budgets, and monitor investments from the palm of your hand or any device with an internet connection.

Security Features Explained

One major concern. However, these apps prioritize protecting your sensitive information through various security features:

- Encryption: Finance apps use encryption technology to encode your financial data during transmission and storage. This ensures that even if someone intercepts the data, they won’t be able to decipher it without the encryption key.

- Multi-factor authentication: To add an extra layer of security, many finance apps offer multi-factor authentication. This means that in addition to entering your username and password, you may also need to provide another form of verification such as a fingerprint scan or a unique code sent to your mobile device.

- Secure connections: Finance apps establish secure connections with financial institutions by utilizing protocols like HTTPS (Hypertext Transfer Protocol Secure). This ensures that any communication between the app and external servers remains encrypted and protected from unauthorized access.

- Biometric authentication: Some finance apps allow users to utilize biometric authentication methods like fingerprint or facial recognition technology for logging in. These biometric identifiers are unique to each individual and provide an additional layer of security.

- Data privacy policies: Reputable finance apps have stringent data privacy policies in place to safeguard your financial information. They outline how your data will be collected, stored, and used, ensuring that it is handled responsibly and in compliance with relevant regulations.

It’s important to note that while finance apps implement robust security measures, users also play a crucial role in maintaining the security of their financial accounts. This includes setting strong passwords, regularly updating the app and device software, avoiding public Wi-Fi networks when accessing sensitive information, and being cautious about sharing personal details.

Alternatives to Using Budgeting Apps

Pros and Cons of Alternatives

While budgeting apps can be a great tool for managing personal finances, they may not be the best fit for everyone. Here are some alternatives to consider, along with their pros and cons.

- Pen and Paper: Going old school with pen and paper allows you to physically see your budget and expenses laid out in front of you. It can help you develop a deeper understanding of your financial situation. However, it requires manual calculations and can be time-consuming.

- Spreadsheets: Utilizing spreadsheet software like Microsoft Excel or Google Sheets provides more flexibility compared to pen and paper. You can create customized templates, track expenses, and perform calculations easily. However, it may require some knowledge of spreadsheet functions and formulas.

- Envelope System: This method involves separating cash into different envelopes based on various spending categories such as groceries, entertainment, or transportation. It helps limit overspending since you only use the money available in each envelope. On the downside, it requires discipline to stick to the allocated amounts for each category.

- Mint.com: Mint.com is an online platform that offers similar features as budgeting apps but without the need for downloading an app on your phone. It allows users to connect their bank accounts, track expenses, set budgets, and receive alerts when bills are due or when they exceed their budget limits.

- Financial Advisors: Seeking advice from a financial advisor can provide personalized guidance tailored to your specific financial goals and circumstances. They can assist in creating a comprehensive financial plan that includes budgeting strategies along with investment advice and retirement planning.

When to Consider Alternatives

There are certain situations where using alternative methods might be more suitable:

- Limited Internet Access: If you have limited access to the internet or prefer offline methods of tracking your finances, using pen and paper or spreadsheets can be a viable option.

- Simplicity: Some individuals may prefer a simpler approach to budgeting without the need for complex apps or software. The envelope system, for example, offers a straightforward way of managing expenses.

- Specific Budgeting Needs: If you have unique budgeting needs that are not adequately addressed by budgeting apps, such as managing irregular income or handling multiple currencies, alternative methods like spreadsheets or financial advisors can provide more flexibility and customization.

- Preference for Physical Interaction

FAQs on Personal Finance Management Apps

Best Practices for App Use

Using a mobile app can be a game-changer. However, to make the most of these apps, it’s important to follow some best practices:

- Set Clear Financial Goals: Before diving into any personal finance app, take some time to define your financial goals. Whether it’s saving for a vacation or paying off debt, having clear objectives will help you stay focused and motivated.

- Track Your Expenses: One of the key features of personal finance apps is expense tracking. Make sure to diligently input all your expenses into the app. This will give you a clear picture of where your money is going and help identify areas where you can cut back.

- Create a Budget: Most personal finance apps offer budgeting tools that allow you to set spending limits in different categories. Take advantage of this feature by creating a realistic budget that aligns with your financial goals.

- Automate Savings: Many apps provide options for automating savings by setting up recurring transfers from your checking account to a savings account or investment portfolio. By automating savings, you ensure that money is set aside consistently without relying on manual transfers.

- Regularly Review Your Finances: Make it a habit to review your finances regularly using the app’s reporting and analysis features. This will help you track progress towards your goals, identify areas for improvement, and make necessary adjustments along the way.

Overcoming Common Challenges

While personal finance management apps are incredibly useful tools, they can come with their own set of challenges:

- Security Concerns: Entrusting an app with sensitive financial information may raise security concerns for some users. To mitigate this risk, choose reputable apps that employ robust security measures such as encryption and two-factor authentication.

- Learning Curve: Some users may find it challenging to navigate and understand the various features of personal finance apps. To overcome this, take advantage of tutorials and user guides provided by the app developers. Start with a simple app that offers a user-friendly interface.

- Account Integration: Integrating all your financial accounts into one app can be time-consuming and may require additional setup steps. However, once you have set up the integration, it provides a comprehensive view of your finances in one place.

- App Reliability: Like any other software, personal finance apps can occasionally experience glitches or downtime.

Conclusion

In conclusion, personal finance management apps offer a convenient and effective way for beginners to take control of their finances. Decoding budgeting apps and understanding their top features can help users make informed choices when selecting the right app for their needs. The best budgeting apps for beginners in 2023 provide a user-friendly interface and essential features like expense tracking, budget creation, and goal setting. Specialized budgeting apps cater to various needs such as investing, saving for retirement, or managing debt.

When evaluating the cost of finance management apps, it is important to consider both the upfront fees and any ongoing subscription costs. User reviews and ratings play a crucial role in ensuring the reliability and effectiveness of these apps. Furthermore, data security should be a priority when choosing a finance app, with encryption and secure authentication measures being essential features to look out for.

While personal finance management apps are a valuable tool, they are not the only option available. It is worth exploring alternative methods such as spreadsheets or working with financial advisors to find the approach that best suits individual preferences and goals. By taking advantage of these resources, beginners can gain confidence in managing their finances and work towards achieving financial stability.

FAQs

What are personal finance management apps?

Personal finance management apps are mobile applications that help individuals track and manage their finances. These apps provide features such as budgeting tools, expense tracking, bill reminders, and goal setting to assist users in gaining control over their financial situation.

How can personal finance management apps benefit beginners?

Personal finance management apps are beneficial for beginners as they offer a user-friendly interface and simplified features that make it easy to understand and manage finances. These apps provide insights into spending habits, help create budgets, and offer tips for saving money, enabling beginners to develop good financial habits.

Are personal finance management apps secure?

Yes, reputable personal finance management apps prioritize security measures to protect users’ financial data. They use encryption technology to safeguard information and often require authentication methods like passwords or biometrics. However, it is crucial to choose well-known and trusted apps from reliable sources to ensure maximum security.

Can personal finance management apps be used for multiple accounts?

Certainly! Most personal finance management apps allow users to link multiple bank accounts, credit cards, and investment accounts in one place. This feature enables individuals to have a comprehensive view of their overall financial health without the need for manual calculations or switching between different platforms.

Do personal finance management apps have customer support?

Yes, many personal finance management apps provide customer support through various channels such as email or live chat. Users can reach out with any inquiries related to app usage or encounter any technical issues. It’s advisable to check the app’s website or support section for specific details on available customer support options.